Road to Net Zero: How countries are adopting EVs

The Paris Agreement is an international treaty on climate change that thousands of countries across the globe adopted in 2015. The mission is to reach global net zero emissions around 2050. Whilst there aren’t specific targets in the agreement to adopt electric vehicles, energy innovation estimates that there should be 60% global zero-emission vehicle sales in 2030, and 100% by 2035 to align with the net-zero emissions by 2050 target.

With this in mind, CarMoney has analysed the top economy countries by GDP with net-zero targets, to uncover how they’re adopting to new EVs and how this will impact their Paris Agreement goals.

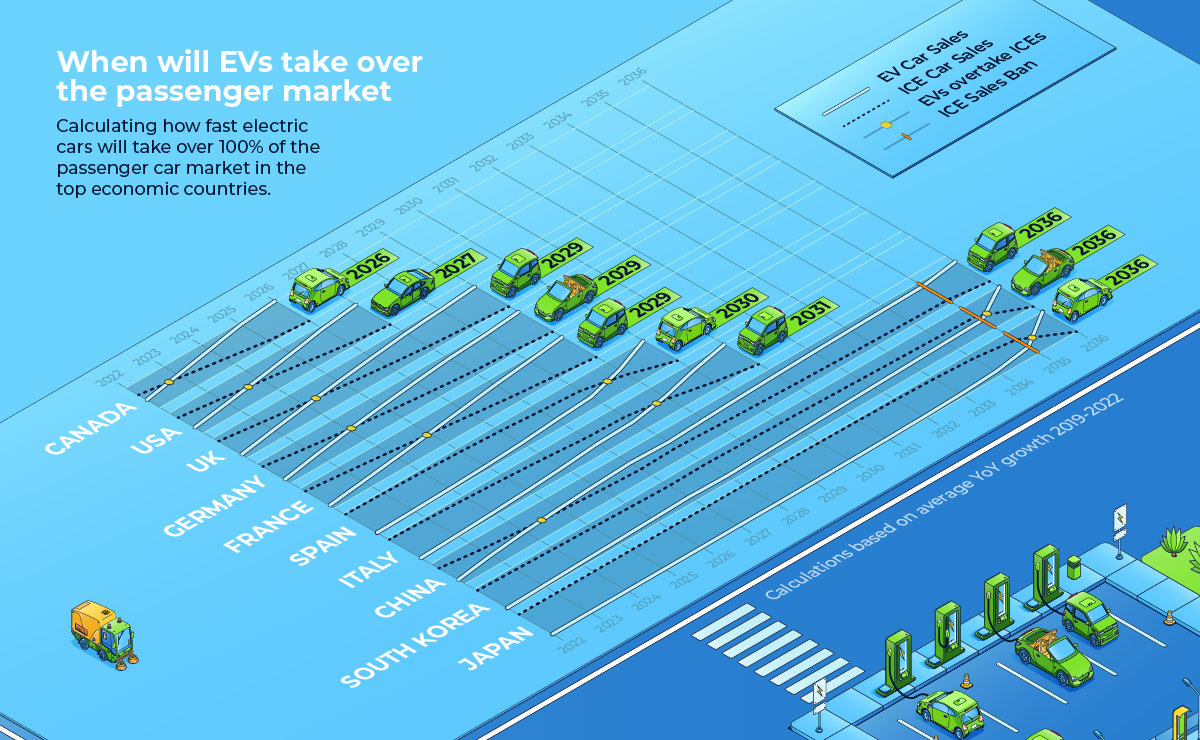

Canada is predicted to be the first country to commit to all-electric driving

Our data analysis has revealed that as soon as 2023 electric car sales in Canada will outweigh internal combustion engine (ICE) cars, taking up 55% of the market share. Which would make Canada the first country to meet net-zero targets, based on electric cars alone.

By 2026, Canada is predicted to be the first country to fully commit to electric passenger cars with zero ICE car sales, and a huge 278,081 EV sales. This is nine years earlier than Canada’s EV mandate in which all passenger vehicles and light trucks sold after 2035 will be electric zero-emission vehicles.

The USA is close behind Canada with EV sales exceeding ICE cars by 2024

The U.S. government plans to make half of all new car sales electric by 2030, however, forecasting has revealed they could meet this target as early as 2024, with EVs taking up 55% of new car sales.

If the predicted trajectory of ICE and EV sales is to continue, the US could stop selling ICE cars by 2027. Putting them on track to meet 2050 targets based on electric cars.

Even sales of electric buses have grown exponentially, from 2021 to 2022 sales increased by 63% with 3,912 sales in 2021, and 6,359 in 2022.

The UK lags behind, despite having an ICE ban target five years earlier than most

Despite having a ban on sales of new ICE cars in 2030, five years earlier than Canada’s ban, the UK marginally lags behind Canada, and the US – a country with no official ICE ban.

Sales of new electric vehicles are predicted to surpass gas-powered cars in 2025, two years behind Canada, and one year behind the US.

However, although the UK falls behind our friends across the pond, sales of ICE cars are forecasted to stop one year earlier than the 2030 ban. In 2028, EV sales are predicted to take up over 90% of the market share, and by 2029 this is estimated to be 100%.

South Korea has the slowest adoption rate of EVs

Climate Action Tracker, an independent project that tracks government climate performance against the Paris Agreement, notes that South Korea is making progress in climate change mitigation, but lacks the speed to meet the agreement. The country is one of the world’s most fossil-fuel-reliant economies, and evidently struggling in meeting climate goals.

Just recently the government had to cut their targets for reducing emissions in the industrial sector. The new plan will mean the industrial sector will only have to cut their emissions by 11%, instead of 15%.

Not to mention the country has been extremely slow compared to top economy countries to adopt EVs. In 2022, EVs only share 6% of the passenger car market. In 2030, this is still low at 26%. Electric cars will only take over until South Korea’s government ban of new gas-powered car sales in 2035.

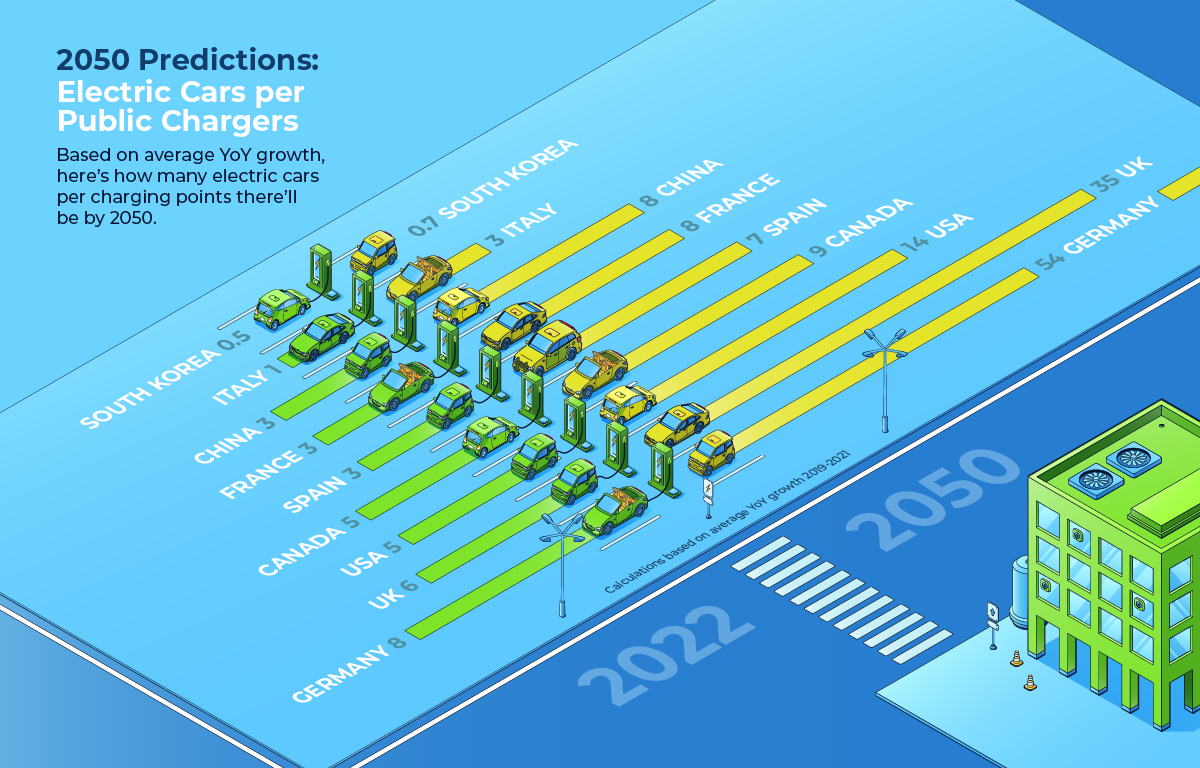

South Korea’s charging infrastructure is miles above the rest with 0.5 electric cars per public charger

Despite South Korea having one of the slowest adoption rates of electric cars, their charging infrastructure is miles ahead with 0.5 EVs per public charger in 2022, in 2050 this is predicted to be 0.7 EVs per charger.

Although it seems this low EV per charger rate is because there’s a smaller number of EVs on the road, our analysis has uncovered this is not the case at all. In fact, in 2021 South Korea had the third-highest number of public chargers (107,000), with China first, and the US second. In 2022, this was predicted to be a huge 166,602, higher than the US at 138,922.

Italy has the second-best charging infrastructure with 1 EV per charger

Italy’s registered EVs are on the low side compared to other top economic countries, however, the country’s public charger network is growing at a much higher rate. Out of the countries analysed, Italy’s growth rate of public chargers is the highest at 56%.

This means in 2022 Italy’s charger network is expected to be at 1 EV per charger, and by 2050 is predicted to be 3 electric cars per charger.

Germany is expected to have the worst charging infrastructure with 54 EVs per public charger in 2050

Germany has one of the best EV adoption rates out of the top economic countries with EV sales surpassing ICE cars as soon as 2025. However, the growth of the country’s charging infrastructure doesn’t have the same speed – the average YoY growth between 2019-2021 is just 14%. Making this the lowest of all the top economic countries.

In 2022, there are 8 electric cars per public charger. But, if nothing changes there could be serious issues. At the current growth rate of public chargers and EVs, by 2050 there will be 54 electric cars per charger. Substantially not enough to sustain Germany’s ICE car sales ban in 2035.

The UK has the second-worst public charger network with predicted 35 EVs per charger in 2050

There were a whopping 267,203 new registrations of electric cars in 2022, taking up 16% of the passenger car market share. EV adoption in the UK has grown exponentially since 2019, with an average YoY growth of 110%.

However, although the EV adoption rate is ahead, it appears the charging infrastructure is falling behind. The average YoY growth for EV chargers is at just 17%, this predicts that at the end of 2022, there will be 6 electric cars per EV charger. If that wasn’t a big enough queue, by 2050 this is forecasted to be a whopping 35 electric vehicles per charger.

Want to read more automotive news? Check out our blog on the latest happenings in the auto world.

Methodology

Car Money calculated the average YoY growth from 2019-2022 for new passenger cars, and 2019-2021 for public chargers. Data was sourced from the International Energy Agency, EV Universe and the International Organization of Motor Vehicle Manufacturers (OICA), to accurately predict the growth percentage of electric cars, ICE passenger cars, and public chargers up to the year 2050, and how the future adoption of electric cars will impact the Net Zero commitments of the top economic countries in the world.