What is Personal Contract Purchase?

- No Deposit

- We help find you the perfect car

- PCP and HP from 8.9% APR

- Free car history and dealer quality check

PCP is the most popular finance agreement for consumers wishing to change their car easily and often.

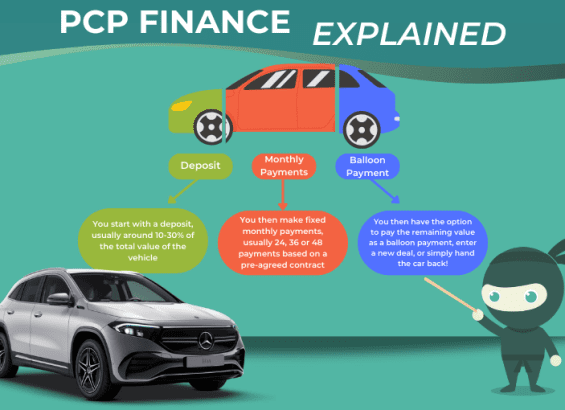

Similar to an HP agreement, Personal contract purchase consists of paying an initial deposit, followed by monthly payments – although there are deposit-free options available.

PCP differs from HP as the monthly payments only pay for the depreciation of the car, whereas with HP the monthly payment pays towards the ownership of the car.

At the end of the agreement, you can return the car. If you want to own it outright, you’ll need to pay a lump sum.

Representative Example: Borrow £7,000 with £1,000 deposit over 48 months with a representative APR of 17.9%, monthly payment would be £171.83, with a total cost of credit of £2,247.83 and a total amount payable of £8,247.83. CarMoney Limited can introduce you to a limited number of finance providers based on your credit rating and we will receive a commission for such introductions this can either be a % of the amount borrowed or a flat fee. This does not influence the interest rate you’re offered in any way. CarMoney is a broker not a lender.

Partners

Features

How Does PCP Work?

Deposit & Payment

- This is tailored to your requirements. A larger deposit will mean lower monthly payments, although many lenders offer deposit-free options.

Annual Mileage

- Tailored to individual requirements.

Guaranteed Minimum Future Value (GMFV)

- Also known as the balloon payment, this is the expected value of the car at the end of the agreement. This will need to be paid if you want to own the vehicle outright.

Options at the End of the Agreement

- Own the car outright – by paying the balloon payment

- End the agreement – by handing the car back to the finance company

- Part Exchange the vehicle for another car

Want to know more about what types of finance we offer? Read our Car Finance page and find out why we are the best broker for you!

Benefits of PCP Agreements

- Low initial deposit

- Low monthly payments

- Flexible options at the end of the agreement

- A specified Guaranteed Minimum Future Value (GMFV), therefore protecting you from market fluctuations

- Ability to change car more regularly – every 2 years

Considerations

- If you exceed the anticipated annual mileage there may be an excess mileage charge at the end of the contract

- The loan is secured against the vehicle. If you miss payments then the vehicle may be repossessed

If you still can’t decide if personal contract purchase is right for you, then contact CarMoney. We’ll discuss it with you so you can make an informed decision.

Frequently Asked Questions

What is PCP Finance?

PCP car finance offers the opportunity to drive a new car without needing an upfront payment. Instead, you make regular monthly payments and a final balloon payment. It is important to carefully consider your options and compare various deals before deciding.

How does PCP Finance work?

When you take out a PCP car finance agreement, you will need to make a deposit, which is typically 10-20% of the value of the car. You will then make fixed monthly payments over the term of the agreement. At the end of the term, you will need to pay the final balloon payment if you want to keep the car.

What are the benefits of PCP Finance?

Lower monthly payments than traditional car loans, the flexibility to choose what you do with the car at the end of the term, no need to worry about the car depreciating in value, are the best benefits of PCP. However, it is important to note that PCP car finance is not without its risks. For example, you could end up owing more money than the car is worth if you choose to keep it at the end of the term. Additionally, if you exceed the agreed mileage allowance, you may be charged extra fees.

What happens if I exceed the mileage allowance on my PCP agreement?

If you exceed the mileage allowance on your PCP agreement, you will typically be charged an excess mileage fee. This fee is charged per mile and is usually around 5-15p per mile. The excess mileage fee is designed to cover the depreciation in value of the car caused by the extra mileage.

Future-Proofed Car Ownership

Our PCP finance gives you flexible options to drive the latest models, trade in your car, or own it outright at the end of the term.

Low Monthly Payments

Get affordable PCP plans with competitive rates to drive your dream car on a budget.

Quick Approvals

We make it easy to get approved for car finance with our fast and efficient approval process.

Join thousands of happy customers

Our customers love our CarMoney Ninjas

CarMoney Ninja Sean

“Great service, Sean Davidson was great and was always trying to help and give me the easiest experience possible. Thank you very much Sean.”

CarMoney Ninja Alan

“Alan, who I spoke with on the phone, was amazing! He sorted everything out for me, it was so easy and was able to get my car the very next day. Fantastic!”

CarMoney Ninja Sophie

“Sophie who sorted my finance out for car was amazingly nothing was too much trouble for her always kept me up to date. Five stars Sophie. Thanks for everything”

CarMoney Ninja Ellie

“My ninja from start to finish Ellie McGavin I Needed a car it was complete from picking to collecting within 2 days friendly staff great communication brilliant.”

CarMoney Ninja James

“Excellent professional and courteous service nothing too much trouble James was thoroughly committed to helping me source my car”.

CarMoney Ninja Frazer

“Frazer from car money made the experience of getting a car simple and easy. Would definitely recommend to family and friends. Thanks again CarMoney!”

View our Video Testimonials

CarMoney-video-testimonial

CarMoney Ninja William

We Compare the best deals from over 20 lenders