How does PCP work? (Personal Contract Purchase)

Wondering what PCP is all about?

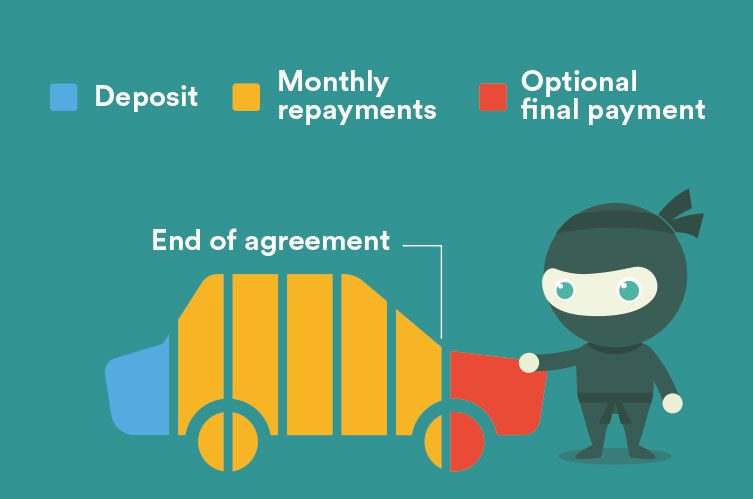

A PCP deal is a new type of loan help you get a new or used car. The clever part is that you won’t be paying off the full value of the car, but instead, just the depreciation. You also won’t own the car at the end of the agreement – enabling you to change cars more often.

It may sound complicated but Nikki has broken it down for you in this post:

Deposit

Typically 10% of the value of the car. However many dealerships will offer a deposit contribution. Ask us about deposit contributions when you call us.

Amount Borrowed

The amount you will need to pay back each month is based on how much value the finance company predicts the car will loose during the term of your contract. Your monthly payments will be much less than if you were to pay off the full value of the car – this is one of the main advantages of PCP.

Final “balloon” payment

This is referred to as a Guaranteed Minimum Future Value in most contracts. It is how much the dealer or finance company predicts the car will be worth at the end of your finance contract. You don’t need to pay this, leaving you to hand the car back and choose a new one.

If you have any other questions about PCP why not call our money saving Ninjas on 0333 456 4550 or chat to them on live chat now and discover how you can get into your next car for less. We also offer HP (hire purchase) finance, find out how HP works…