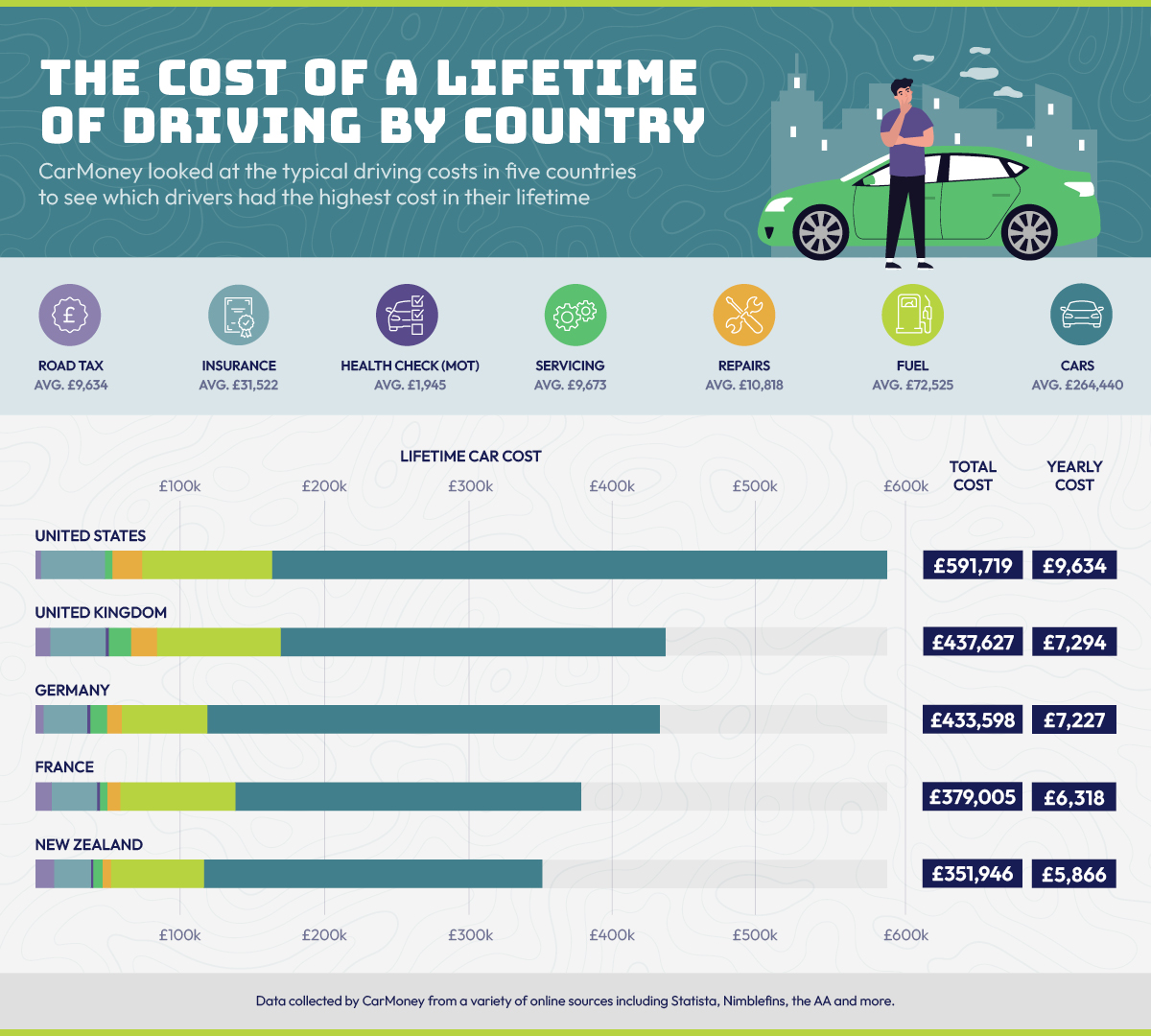

The Cost of a Lifetime of Driving

For drivers, cars are likely one of the most costly expenditures you have after housing and food. But have you ever wondered how much we actually spend over the course of our lifetime on motoring?

CarMoney has calculated the cost of necessary driving spending over a 60-year period in five car-dependent countries including the UK and the US. We’ve investigated costs including buying vehicles, insurance, maintenance and more.

We’ve shown which country’s drivers are shelling out the most for their cars based on the average motoring costs.

The UK is the second most expensive country to own a car, spending £438K in a lifetime

(500 × 247px).png)

Unfortunately, the motoring costs of Brits are the second highest in our study. We are paying on average £7,294 a year on driving totalling a whopping £437,627 over the course of a lifetime thanks to high costs in every category.

Despite being the lowest in some categories, America tops the list of driving costs thanks to their expensive taste in vehicles and high average fuel costs. Drivers pay on average £9,862 a year, £591,719 in their lives.

America’s driving costs were the only country above average at £438,789. Their lifetime costs pushed up the average resulting in an additional £153K.

New Zealand is the cheapest country paying nearly £87K less than the average!

Coming at the bottom of our list is New Zealand with annual driving costs of £5,866 totalling £351,946 in a lifetime. They benefited from low overall expenses coming bottom in three out of seven categories.

France is up next with a lifetime driving cost below the average at £379,055, £6,318 a year. That’s still nearly £60K lower than the global average.

Following France, there is a significant jump to Germany whose drivers are paying £7,227 a year and £433,598 over the course of a lifetime.

The US pay on average £43K for a new car

America came out on top for the cost of buying a new motor with the average driver paying £42,762. Over the course of a lifetime, American drivers paid on average £427,620 on ten new vehicles, replacing one every six years. America suffered due to the higher costs of their preferred vehicles and a penchant for larger-than-average cars.

Germany was in second place paying on average £31,456 per new vehicle. In a lifetime, fees were around £314,560, over £79K more than the average.

The UK is second from bottom with the average new car in 2022 setting drivers back £26,762 thanks to our love of smaller vehicles like hatchbacks, including the soon-to-be discontinued Ford Fiesta. New Zealand had the cheapest cost paying just £23,528 for a new vehicle.

America has the highest fuel cost paying £90K in a lifetime

Despite the states paying the least per litre of gasoline, they topped the overall fuel costs paying an average of £1,505 a year. This is likely because their vehicles travel further and use more fuel due to their size.

The UK wasn’t far behind with annual fuel costs of around £1,435. The UK has the highest cost per litre of gasoline of the countries in our study, currently paying £1.659, the 11th highest in the world.

Germany is in last place for fuel costs paying £990 a year. The country currently pays £1.620 per litre of gasoline but efficient vehicles and lower mileage help to cut costs.

Brits shell out over £35K for repairs and maintenance

Brits are paying out an extortionate £593 a year totalling £35,579 for MOTs, servicing and repairs – that’s a whopping £12,434 higher than the global average. The high costs come from the most expensive service fees at £18,000 a year and the second highest annual health check in the form of MOTs at £2,079.

America is the closest behind spending around £25,980 in a lifetime. Despite not having a mandatory health check, high repair costs at around £346 a year push up costs to drivers.

At the bottom, we have New Zealand where residents pay nearly £10K less in a lifetime for car repairs and maintenance. Their low fees are just £231 a year totalling £13,844 in a lifetime.

Americans are paying over £44K in their lifetime on car insurance

Americans have the highest car insurance costs for a comprehensive policy paying out £740 on average each year. Drivers in 49 out of 50 states must have an insurance policy, costing on average £44,383 in a lifetime.

The UK was close behind with annual fees of £642 for our insurance policies, adding up to £38,528 in a year. France followed with a lifetime cost of £31,562.

Once again, New Zealand takes the bottom spot paying £428 a year on insurance, £25,680 in a lifetime.

Find out how you could cut your motoring costs with finance on your next car. Use our finance calculator to see what you’re eligible for.

Methodology

We gathered information from online sources on common car costs for five countries around the world. Costs are based on current prices over 60 years, the most common time people drive for. For cars, we looked at the price of new vehicles with one purchased every six years – the average time a person owns a vehicle. Resale cost and interest rates weren’t included for simplicity.