Pros + Cons of Car Finance

Buying a car on finance has many benefits. But there are also some pitfalls to avoid. Our car experts give sound advice to help you make an informed decision. It is important to remember that buying a car is one of the top 3 most expensive purchases that you will make, so do not take it lightly! Make sure you do the research into what finance deal would suit you and how much you can afford to pay back each month.

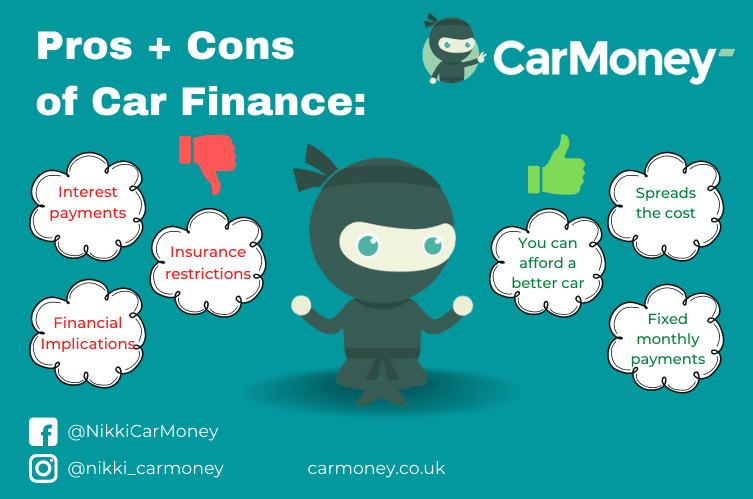

What are the Benefits of Car Finance?

Buying a car on finance has many benefits. It can make cars that seem out of your reach in terms of price seem more affordable. There is no doubt that car finance is a good thing for many people. In 2018, 1.4 million used cars were bought on finance – an increase of 8% from the previous year accounting for nearly a fifth of all used car sales. So what are the main benefits?

- You can afford a better car

- Spreads the cost

- Fixed monthly payments

- Can be driving a car on a tight budget

- You can change your vehicle more often

- Improves credit score

- Deposit contribution on new cars

What are The Pitfalls of Car Finance and How to Avoid Them?

The pitfalls of financing a car are usually due to impulse decision making or not fully understanding the nature of the deal you are signing up to. The following examples are to be considered carefully before taking out a loan:

Interest Payments: As with virtually any type of loan, a car loan requires you to pay interest in addition to the retail value, effectively raising the total cost of the car above the sticker price. Your interest rate will depend on a number of factors, such as your credit history, the lender offering the finance.

Financial Implications: Financing a vehicle can make it easy to bite off more than you can chew. When you’re in the dealer’s showroom, it can be a challenge to avoid the temptation of purchasing a more expensive car than you can truly afford. You might rationalize the higher monthly payment at the time by deciding to cut back on saving and investing. Consequently, your long-term financial outlook may suffer accordingly.

Insurance Conditions: When you finance a vehicle, you’re probably buying a brand-new or late-model used vehicle with a relatively high value, so your auto insurance premiums may also be higher. Additionally, your lender may require you to carry higher liability and physical damage coverage than you normally would to protect its interests.

Mileage Limits: Most agreements will have a limit to the number of miles you are allowed to drive per year, usually around 10-30k miles (depending on your agreement).

Can I still get finance if I have bad credit?

Poor credit history can severely affect your chances of securing any sort of loan/financial service. Those with a lower credit score are less likely to get competitive rates and may even be refused a loan by some of the lenders. There are, however, ways of getting approved for credit even with a poor credit score, known as bad credit car finance, and there are things you can do to improve your score too:

Get a Credit Report: A credit report is a good place to start, as it will show you in detail your credit history including your overall score. It will give you an idea of where you’re going wrong and what you can do to improve your chances of getting finance. You can access a copy of your credit report for free from Experian, Equifax, or Callcredit.

Register on Electoral Roll: If you haven’t already, make sure you register on the electoral roll. Finance companies look at this when they perform credit checks to see if your name and address match up. If you’re registered on the electoral roll, it makes it easier for finance companies to carry out these checks. Being registered won’t transform your credit rating, but it does help and it’s easy to do.

Keep up repayments: This may seem obvious, I know but even making sure you pay a phone bill every month or pay off a credit card (if applicable). Small steps are the best ways to gain the trust of the lenders!

Keep Applications to a Minimum: The more applications you put in, the more ‘Hard Searches’ will be done on your credit score. If you have a low score and frequently get declined, this can severely affect your score in a negative way. Initially, an eligibility check, or ‘Soft Search’, is a much better idea than a formal application. While it won’t tell you for certain if a finance company will offer you a loan, it will give you a good indication, and it won’t appear on your credit history.

Can I trade-in/part-exchange my car that’s on finance?

A common question we get asked! The answer to this question is yes, you can trade-in or part exchange a car that is on finance and it doesn’t matter whether you have a car on Hire Purchase (HP) or Personal Contract Purchase (PCP), the process is simple. There are a few steps you will need to take in order to do this:

- Get a settlement figure from your current lender.

- Find out the value of your car with any valuation tool. All you will need is your registration.

- Next, time for a tiny bit of maths, subtract the settlement figure from your car’s valuation price. This will equal the amount of equity available in your car. If you have a positive figure, great news! You can use this amount of money as a part exchange for your next car. However, if the figure is negative, you’ll need to pay that amount of money on top of your new car’s price.